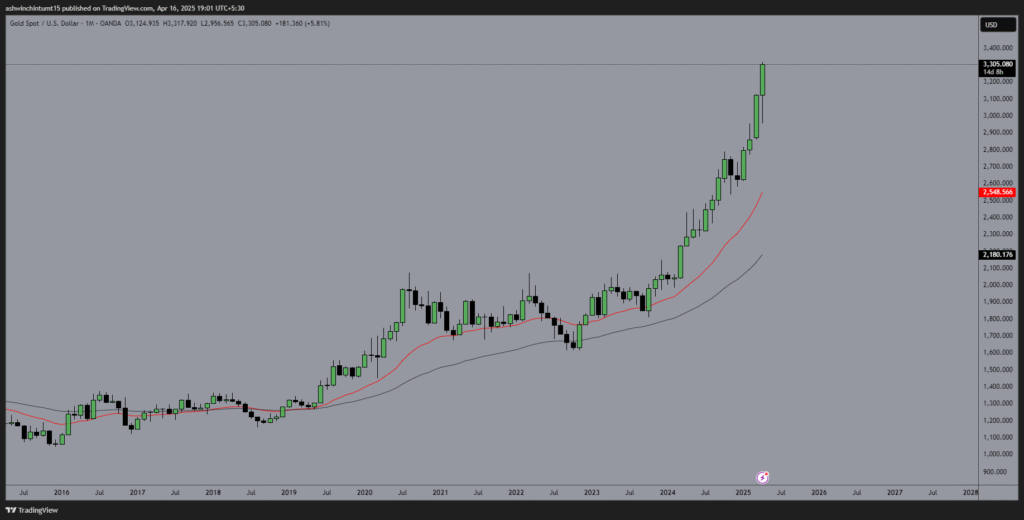

Over the past 15 months, Gold has surged massively in price , rising more than 62% from January 2024 to April 2025.. This historic rise has left investors, analysts, and common man wondering: what’s driving this explosive growth in Gold prices? Is it Inflation, global uncertainty, or a deeper shift in how people view Investment Assets?

In this blog, we’ll explore why Gold has become such a hot commodity again, how Inflation and market instability are fueling this surge, and most importantly—whether this is the new normal for the Asset or a temporary spike. Alongside this, we’ll look at smart Gold Investment options, compare alternative Assets, and offer guidance on what to expect in the near future. Whether you’re holding Gold, planning to Invest, or searching for better Assets that can act as an Inflation hedges—this post is packed with insights you can act on.

Will Gold Prices Keep Rising or Crash Soon?

The price of gold has been on a roller coaster ride but on only one side, surging by over 62% between January 2024 and April 2025. This Intense spike has raised eyebrows across global markets, especially among investors seeking stability amidst growing inflation and economic uncertainty. But the real question remains—is this just the beginning of a new gold era, or are we heading toward an inevitable correction?

Historically, gold has always thrived in periods of economic instability, acting as a hedge against devalued currencies and volatile equity markets. However, recent price trends seem to be driven not just by inflation fears but also by institutional buying, geopolitical tensions, and a weakened dollar. If these factors persist, experts believe the price of gold could still climb further in 2025—but if inflation cools or interest rates rise unexpectedly, a sharp pullback is not off the table.

Is Gold Still a Safe Investment in 2025?

In 2025, Gold remains one of the safest and most reliable investment assets, especially as stock markets continue to swing wildly with daily index drops of 4–5% and individual stocks plunging over 10%. Amid trade wars, tariff tensions between US and China, and rising inflation, gold offers a sense of stability that real estate and other high-growth assets currently lack. While it may not generate income like stocks or crypto, gold has still delivered solid returns during this volatile period. For investors aiming to protect wealth and diversify their investment portfolio, gold stands strong as a smart, reliable and strategic hedge against economic uncertainty. To know more check out Gold Rush 2025: How to Invest in Precious Metals Like a Pro

Top Alternatives to Gold for Hedging Inflation

While Gold remains a trusted investment, many are now exploring alternative assets to hedge against inflation in uncertain times. Real estate, silver, oil, and cryptocurrencies like Bitcoin are gaining attention for their potential to outpace inflation and diversify investment portfolios. Real estate, for example, often keeps pace with inflation through increasing rental income and property values. Among these, cryptocurrency stands out for its high profit potential, though it does come with greater risk. These investment alternatives offer growth opportunities while also acting as buffers against rising prices and currency devaluation.

How to make an Investment in Gold Without Buying Physical Bullion

Not everyone wants to buy physical gold like jewellery, coins, bullions and worry about their storage, theft and other issues -which is why more investors in 2025 are exploring ways to invest in gold without holding physical bullion. Digital avenues like gold ETFs (Exchange-Traded Funds), gold mutual funds, and even sovereign gold bonds have made it easier than ever to gain exposure to gold without the hassle. These paper or digital forms of gold investment provide liquidity, flexibility, and are accessible with just a few clicks. Whether you’re diversifying your portfolio or seeking a hedge against inflation, investing in gold digitally is a smart, accessible move for modern investors.

Gold vs. Other Assets: Which One Wins in 2025?

When comparing gold to other assets in 2025, it clearly holds a unique edge in the past and even now in the present during times of high inflation and market turbulence. Unlike stocks or crypto, which have shown extreme volatility, gold has offered stability and consistent value, making it a trusted investment for risk-averse individuals. Real estate and digital currencies may offer higher returns, but they lack the safe-haven status that gold brings during uncertain economic cycles. For investors seeking balance between growth and protection, gold continues to outperform many competing investment assets this year.

Conclusion: Is Gold the Ultimate Investment in 2025?

In a year defined by economic uncertainty, soaring inflation, and unpredictable markets, gold has proven once again why it remains a cornerstone investment asset. While it may not deliver the highly explosive returns of stocks or crypto, gold’s ability to preserve value and offer stability makes it one of the most trusted assets in any economic situation. For investors seeking both protection and portfolio diversification, gold stands tall as a smart, reliable long-term hedge against inflation and volatility.

If you’re evaluating your next investment decision, this could be the perfect time to explore gold-backed ETFs, sovereign bonds, or even digital gold as accessible and strategic options. Ready to future-proof your finances? Start small, diversify wisely, and let gold play its role in securing your wealth in 2025 and beyond.👉 Open your free demat account today with Zerodha or Dhan and start investing smart!

Pingback: Gold and Bitcoin Stocks Surge in January 2026: Mining Giants and Crypto Stocks Lead Market Rally