Understanding the Reasons Behind the Falling Stock Market in India: Sensex and Nifty Crash

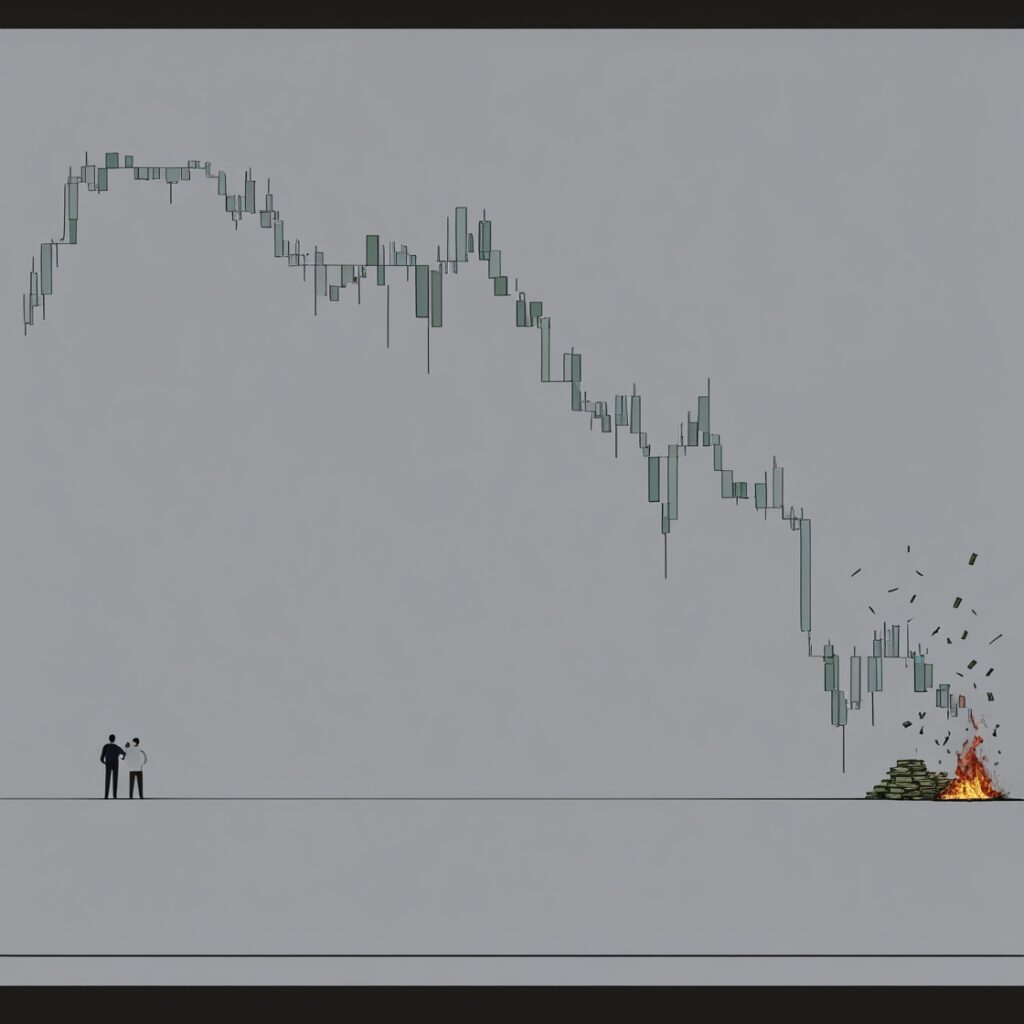

The stock market in India is currently experiencing a significant crash, with both the Sensex and Nifty indices consistently falling. This downward trend has left investors anxious and questioning the underlying causes. Is it global market turmoil, the impact of RBI policies, or widespread investor panic? As fears of further losses grip traders, the volatility in the market raises concerns about whether this is merely a correction or the onset of a more profound downturn.

Key factors contributing to this stock market crash include persistent selling pressure from foreign institutional investors, rising US bond yields, and a strengthening dollar that diminishes the attractiveness of Indian equities. The BSE Sensex has plummeted to lows not seen since September 2024, while the Nifty index has also faced substantial declines. With the market deep in the red, it is crucial to explore these dynamics to understand the implications for investors navigating this turbulent landscape.

How Global Market Trends Impact the Stock Market Crash in India: Sensex and Nifty Under Pressure

The stock market in India is significantly influenced by global market trends. Rising inflation, geopolitical instability, and economic slowdowns in major economies can trigger a ripple effect, impacting the Sensex and Nifty. For instance, the Economic Survey 2025 warns that a potential market correction in the U.S. could have a cascading effect on India, especially given the increased participation of relatively new retail investors1.

When the U.S. or European stock markets decline, it often sparks panic selling in Indian equities1. This is further exacerbated by foreign investors withdrawing funds, putting additional pressure on the Sensex and Nifty, worsening the ongoing market crash 4. Global trade tensions, such as those arising from potential US tariff policies, also contribute to Foreign Portfolio Investor (FPI) outflows, adding to the market’s instability 4. However, some firms remain bullish, citing India as a “market to beat” among emerging markets in 2025 due to strong earnings growth and a favorable policy environment 2. Despite short-term volatility, India’s strong structural growth outlook and economic resilience suggest a potential for recovery and compelling long-term investment opportunities 36.

The Impact of RBI Policies on the Stock Market in India

The Reserve Bank of India (RBI) influences the Indian stock market through its monetary policies. Interest rate adjustments, like rate hikes, can reduce liquidity and slow investments, affecting the Sensex and Nifty 13. While a repo rate reduction aimed to stimulate growth, the market’s volatile reaction showed the complex interplay between RBI policies and market performance12. The RBI’s approach balances economic growth with inflation management.

The Impact of Corporate Earnings and Investor Sentiment

Weak corporate earnings are contributing to the stock market’s decline. Companies failing to meet expectations lead to stock price drops, impacting the Sensex and Nifty4. This is amplified by negative investor sentiment1. The Economic Survey 2025 warns of a potential U.S. market correction affecting India, especially given new retail investors3. Despite challenges, some analysts are optimistic about India’s long-term growth2.

The Role of FIIs and DIIs in the Stock Market in India

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) significantly influence the Indian stock market. Increased selling by FIIs has created downward pressure on the Sensex and Nifty. FIIs have offloaded nearly ₹60,859 crore (approximately $7 billion) of Indian stocks1. While DIIs try to stabilize the market, their efforts are often overshadowed, highlighting the critical role of institutional investors.

Conclusion: What’s Next?

The Indian stock market remains volatile, influenced by external and internal factors. The Sensex and Nifty fluctuate due to global uncertainties, RBI policies, and weak corporate earnings. Investors should remain cautious, monitoring global trends, interest rates, and earnings to navigate this uncertain landscape. The coming weeks will be critical to determine market stability.

Pingback: Stock Market : What to Watch out on Monday (April 21, 2025)