As we approach a new trading week on 21 Apr 2025, stock market Analysts, Investors and traders are eagerly awaiting to understand the signals and factors that could determine the opening trends on Monday. With a plethora of financial and economic data, domestic Q4 earning reports, the geopolitical scenario unfolding before us and the prevalent market volatility, every small information matters, whether one is an active day trader or long term investor as knowing what stocks to watch in the stock market on Monday could give you a head start.

Stock Market Outlook for Monday: Global and Local Drivers to Watch

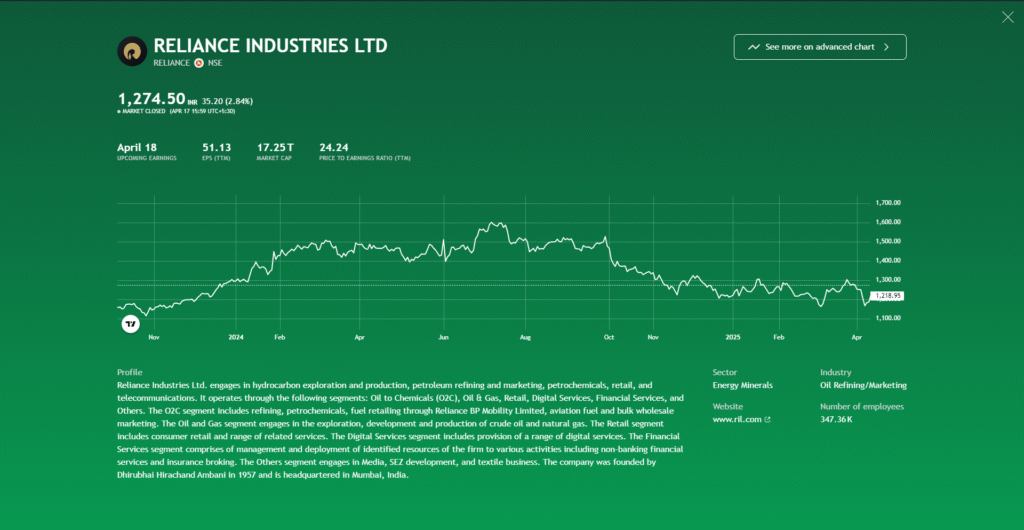

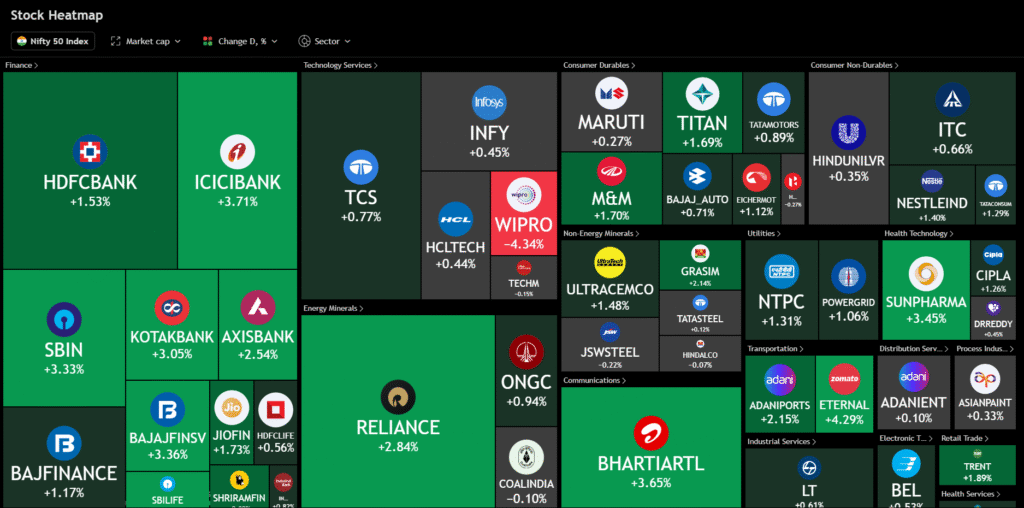

The tone for the domestic stock market outlook for Monday, Apr 21, 2025 is expected to be shaped by global cues and key domestic earnings. Lower than expected China GDP data and the Federal Reserve’s cautious tone may influence the early sentiment. Rising Middle East tensions, Sino-US tariff war and upcoming U.S. retail data could impact the global risk appetite. Back home, investors will react to Q4 results from Reliance Industries, HDFC and ICICI Banks, while tracking FII flows and rupee movement. Overall, the Indian stock market may open with a cautious yet reactive tone.

Pre-Market Trends and Futures Movement for April 21

Indian stock market trends for April 21, 2025, are expected to open cautiously due to the mixed global cues and Q4 earnings from major Indian corporates. The Nifty 50 and Sensex ended higher on April 18, thanks to gains in the banking and IT sector. Focus will remain on SGX Nifty futures, with Reliance Industries and HDFC/ICICI Banks earnings likely driving early volatility. Global factors like U.S. retail data and crude oil prices may influence the opening. Overall, the market may start with a slight bullish bias, discounting fresh global shocks.

Stock Market Earnings to Watch This Monday: Companies Set to Move the Market

Key stock market earnings for Monday, April 21, 2025, are likely to drive significant movements in the Indian indices. All eyes will be on Reliance Industries and ICICI Bank, both scheduled to report their Q4 results, which could influence sectoral trends in energy and banking. Market participants will also track numbers from Ultratech Cement and HDFC Life, given their weight in the Nifty pack. Earnings from these companies could sway investor sentiment and trigger short-term volatility. With heavyweight results lined up, Monday’s stock market session may see sharp sector rotations and momentum plays. To know more about earning click here

Sector Watch: Which Stock Market Segments Could Outperform on April 21, 2025?

As the stock market gears up for Monday, April 21, 2025, investors are expected to keep a close eye on the tech, energy, and financial sectors. The technology segment may outperform, fueled by anticipated earnings from major AI and semiconductor players. Energy stocks are expected to remain active due to ongoing concerns around global oil supply disruptions and price volatility. Financials could also trend higher if the Federal Reserve maintains a pause in rate hikes, as speculated by analysts. While these trends highlight key areas to monitor within the stock market, this information is provided strictly for educational purposes and should not be seen as financial advice or a recommendation to buy or trade any securities. Always consult with a professional before making investment decisions.

Trading Strategy for April 21: What Smart Investors Are Planning

Heading into Monday, April 21, 2025, smart investors in the stock market are expected to lean on technical analysis and sound risk management to navigate volatility. Market sentiment appears cautiously optimistic, especially in sectors with strong earnings outlooks and favorable patterns. Some traders are eyeing potential breakout setups in tech and energy, though confirmation is still awaited. It’s also expected that stop-loss strategies will be widely used to guard against sharp reversals. While these approaches reflect current stock market expectations, this content is intended solely for educational purposes—not as trading or investment advice. Please seek guidance from a qualified advisor before acting on any strategy. To know more about Trading and Investing.

Conclusion: How to Approach the Stock Market This Monday With Confidence

Having a clear strategy can make all the difference. Whether you’re a short-term trader or a long-term investor, focusing on key sectors and monitoring technical indicators will be essential. A balanced approach—with attention to risk management—can help you handle market swings with more clarity. Staying updated with reliable data and keeping emotions in check builds real confidence. Ultimately, the more prepared you are, the more confidently you can engage with Monday’s stock market session.

Pingback: Navigating the Currents: Latest Finance and Investment Trends for Indian Investors